The Impact of Financial Stress on Men Versus Women

- ThinkAlike Laboratories

- Feb 17, 2023

- 1 min read

As the COVID-19 pandemic eases, most of America is experiencing the effects of inflation. Between rising energy and food, many Americans have had to completely re-evaluate their relationship with money as the increasing cost of living crisis persists.

For the past several years, we asked respondents how concerned they are about the financial repercussions of COVID-19. In our latest survey, 13% more women (67%) reported being concerned about the economic effects of COVID-19, while just 54% of men share that sentiment.

Consistent with previous findings, we observe that financial stress has a disproportionately negative impact on women. For example, according to our latest survey, 97% of women have been affected by financial worries, compared to 88% of men.

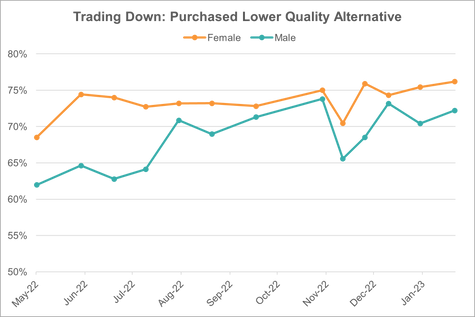

However, our findings show that most respondents suffer from money woes, regardless of gender. Specifically, we found that 76% of women and 72% of men have purchased a lower-quality alternative to save money on at least one occasion since May 2022. Additionally, we found that 92% of women and 82% of men have reduced their overall spending due to inflation.

Last updated on February 17, 2023. Please check back for updates. Results based on surveys of 289 respondents from January 27, 2023 through January 31, 2023. All surveys were conducted online from respondents in the United States. For more information about our survey techniques, click here to visit our Methods page.